When Did the Stock Market Succeed Again

If you invest in the stock market place, you'll somewhen experience emotions of euphoria, greed, fear, uncertainty, and self-loathing. The more than emotionally weak yous are, the less probable you'll savour investing in stocks and holding on for the long term. Losing money stinks.

Given I spent my career working in equities from 1999 – 2012, I witnessed plenty of highs and lows. From people making millions to losing information technology all, I've seen enough. And given I left in 2012, I as well missed out on many good years.

Therefore, I never got the courage to go all-in on stocks after the age of 35. The volatility bummed me out. Instead, I've diversified my cyberspace worth into real estate, venture debt, venture capital, and alternatives, while keeping my equity exposure to 35% of internet worth at near.

How To Experience Meliorate About Losing Lots Of Money In Stocks

If you invest long plenty, yous will lose coin in the stock market. It is an inevitability. Either the unmarried stock yous bought will accept a bad quarter or the fresh money you invested into an index ETF will inexplicably start to sell off soon afterwards.

Recently, i of my top holdings, Netflix, reported terrible subscriber growth guidance. Equally a issue, my $200,000 position lost over $fifty,000 in value in a single day! Ouch.

Not only was my Netflix stock down over $l,000 in a day, so were plenty of my other tech stocks and index funds during this latest market correction. Hundreds of thousands of dollars take evaporated into sparse air.

Easy come, easy go, equally is oft the case with investing in stocks. Simply this time around, something felt dissimilar near losing lots of coin in stocks. I don't feel the same amount of disappointment as I had in previous corrections. Instead, I feel somewhat apathetic.

If you're feeling bad nigh losing money in stocks, peradventure some of these tips tin help you experience better. The reality is, yous could be living with expressionless coin for months or years. Therefore, you've got to figure out a way to move on and alive your life.

1) Get decorated doing hard things.

If yous tackle something really hard and succeed, losing money in the stock market will feel less painful in comparison. You're distracted and engaged. Information technology'due south the juxtaposition betwixt taking action and being a passive investor that really helps put your stock market losses into perspective.

As a passive investor who has no control over a business, there'due south naught you could have done to prevent the losses except to control your asset allocation. Once you lot give into the mantra of command what you can control, you will experience a nice psychological release.

Further, taking activity and succeeding is far more than gratifying than making coin from stocks. Even if y'all don't succeed, but cross the finish line with your life intact, that'due south oft adept enough to counteract any negative feelings about losing money equally well.

If you're not a tennis or sports fan, feel free to skip this next department and go directly to point #two.

Case Of Doing A Hard Matter

On Wednesday night, I got back at 10:30 p.chiliad. because I just played the most hard league lawn tennis match of my life. I had joined a new team with a new doubles partner. The match was indoors at our opponent's facility. Further, I had never won an indoor tennis match in my 12 years of league tennis. At that place's something well-nigh the lights and faster courts that hurt my power to perform at my best.

At #1 doubles, my new partner and I were thrown to the wolves. Information technology was the most important position in the lineup because it counted for two points versus i point. The odds of winning were less than xl%, especially confronting two crafty lefties who had played together for over a decade.

The match started at 7:30 p.m. and nosotros quickly lost the first set 2-6. But nosotros hung on in the second set and won six-four. The turning point came at iv-4, 15-thirty, when our opponent was serving. I called his first serve out, which the server thought was in. They got pissed and began to mentally unravel. Anil, the partner who was non serving, decided to headhunt me twice while I was at the net. Headhunting is when you endeavor to fustigate your opponent'southward caput with the ball. He missed both times as I ducked and both assurance sailed long.

But our opponents regrouped and took the atomic number 82 in the tertiary fix 5-3. The usually noisy indoor society was now quiet as it was nine:40 p.grand. Everybody had gone abode except for the 12 spectators spread across both teams. At this moment, I told myself that if nosotros lose, information technology would exist OK. I had fought my hardest against a tough opponent.

Miraculously, we were able to fight back to half-dozen-6, which meant it was at present time to play a 7-point tiebreaker to determine the victor. Nosotros were up 3-i, when once once again, Anil decided to smash the ball at me while I was at the net. This time, information technology was fair play as the ball was going in. Merely this fourth dimension, I was able to become a racket on it. The ball hitting the tape and dribbled over! Nosotros were up 4-1.

Anil got and so pissed that he smashed the brawl at the net while I was walking past for changeover at 4-2. It made me flinch, only I said null because I wanted to continue the good vibes alive. Nosotros had the momentum! Besides, as a father of two, my warring days are over.

I was serving and nosotros were up 6-4 in the tiebreaker. All we needed was to win ane more indicate to win the match! I ended upwards striking a solid outset serve out wide to Anil. He was forced to pop information technology up to my partner at the cyberspace who proceeded to dump the easy volley into the internet! Nooo! Was my 12-twelvemonth winless expletive going to proceed?

The score was now 5-6 and Anil'southward partner was serving to me. Was I actually going to mess up my return and accident our lead? Heck no! I ended up returning his kickoff serve crosscourt and after a couple of rallies, my partner put an overhead abroad for a victory! We had simply won a ii.five-hr match, the longest in my league-playing career.

Difficult Things Put Stock Losses Into Perspective

I ended upward going to bed at two a.m. that morning considering I didn't want the thrill of victory to disappear. Simply when I woke up, the feeling of triumph was notwithstanding there. Hopefully this feeling will never go away.

Although this match might sound trivial to you, to me, it was an uncomfortable activity that filled me with excitement. Nearly of my lawn tennis friends aren't willing to play USTA league tennis considering they don't desire to be put in a stressful situation.

Had my partner and I lost our lucifer, our squad would take lost ii-iii. Further, our wins and losses are all memorialized on the net for all of the tennis community to run into. So if you lot are a loser, everybody volition know. Equally a effect, most tennis players don't play league tennis. It's only too stressful.

Winning this lucifer successfully negated the hurting of me losing $50,000 in Netflix stock. Sure, I could have sold the stock earlier to avoided losses. However, I've held the stock for 10 years already. Netflix was our saving grace during the pandemic. I'm happy to concord on for a lot longer.

2) Have a diversified net worth.

If y'all have more than 50% of your net worth in one asset grade that is tanking, you lot will likely feel a lot of hurting and fright. As a result, by the time you reach a minimum level of financial independence, I recommended keeping whatever risk asset to less than 50% of your internet worth.

Sure, yous may miss out on some further gains if stocks outperform other asset classes. Still, you'll as well minimize the volatility in your net worth equally well as whatsoever emotional impairment. Of class, if yous have diamond hands, feel complimentary to concentrate your net worth all in stocks or whatsoever risk asset of selection.

All the same, most people who get wealthier over time get more than chance-averse. They go more satisfied with what they accept. Therefore, they're willing to accept lower returns for lower risk. As a result, wealthier people tend to diversify their net worth across many investments.

With a diversified net worth, even if your stocks are tanking, your real estate holdings or bail portfolio might be appreciating in value. You'll tally upward your greenbacks and requite it a virtual hug. Equally a result, you won't experience the pain of stock market place losses as acutely.

Depending on your percentage weighting in stocks, you might actually feel improve when stocks are correcting because you will feel good your diversification is finally paying off. Farther, your other investment might be providing returns that more than make up for your stock marketplace losses.

A diversified cyberspace worth gives you Promise that everything will plow out OK. Often, the biggest challenge to developing a diversified net worth is overcoming greed. Investing FOMO can be extremely hard to overcome. If you are more satisfied with what you accept, information technology'due south easier to give up potentially higher returns by diversifying.

3) Zoom out. Focus on your fiddling ones.

If you're feeling bad nearly losing money in stocks, simply zoom out 5-years, 10-years, and to the maximum time horizon. The more you lot zoom out, the better you lot should experience considering the upward-sloping nautical chart looks smoother, at to the lowest degree for the broader markets.

Your goal is to invest when times are good and bad. Over the long-term, the S&P 500 has performed very well. The problem some investors have is non being able to hold on during downturns. If you can continue on investing during downturns, chances are extremely loftier, ten years from now, you'll brand money.

Another trick to feeling better about your stock losses is to shift your time horizon from yourself to your children if you have any. By thinking well-nigh your children, you beginning viewing selloffs as opportunities, not setbacks.

20 years from now, when your children are adults, how do you retrieve they will view today'due south stock market selloff? Looking dorsum, I believe our children will view it as a wonderful time to buy. As a issue, information technology becomes much easier to invest in your child's 529 plan, custodial investment accounts, and custodial Roth IRA.

four) Await to lose 35% of your wealth.

The global financial crisis resulted in near a 38% correction in the S&P 500 in 2008. The March 2020 meltdown was a 32% correction from peak to trough. Therefore, to brand yourself feel better, take a 35% haircut off the value of your stocks. This way, your realistic downside expectations are set.

One time y'all set low expectations, any losses less than 35% will feel better. Thinking about realistic worst-case scenarios is i of the best ways to extinguish fear. Below is a chart showing the historical returns of the Due south&P 500.

5) Think about all the coin you spent that didn't become invested in the stock market place.

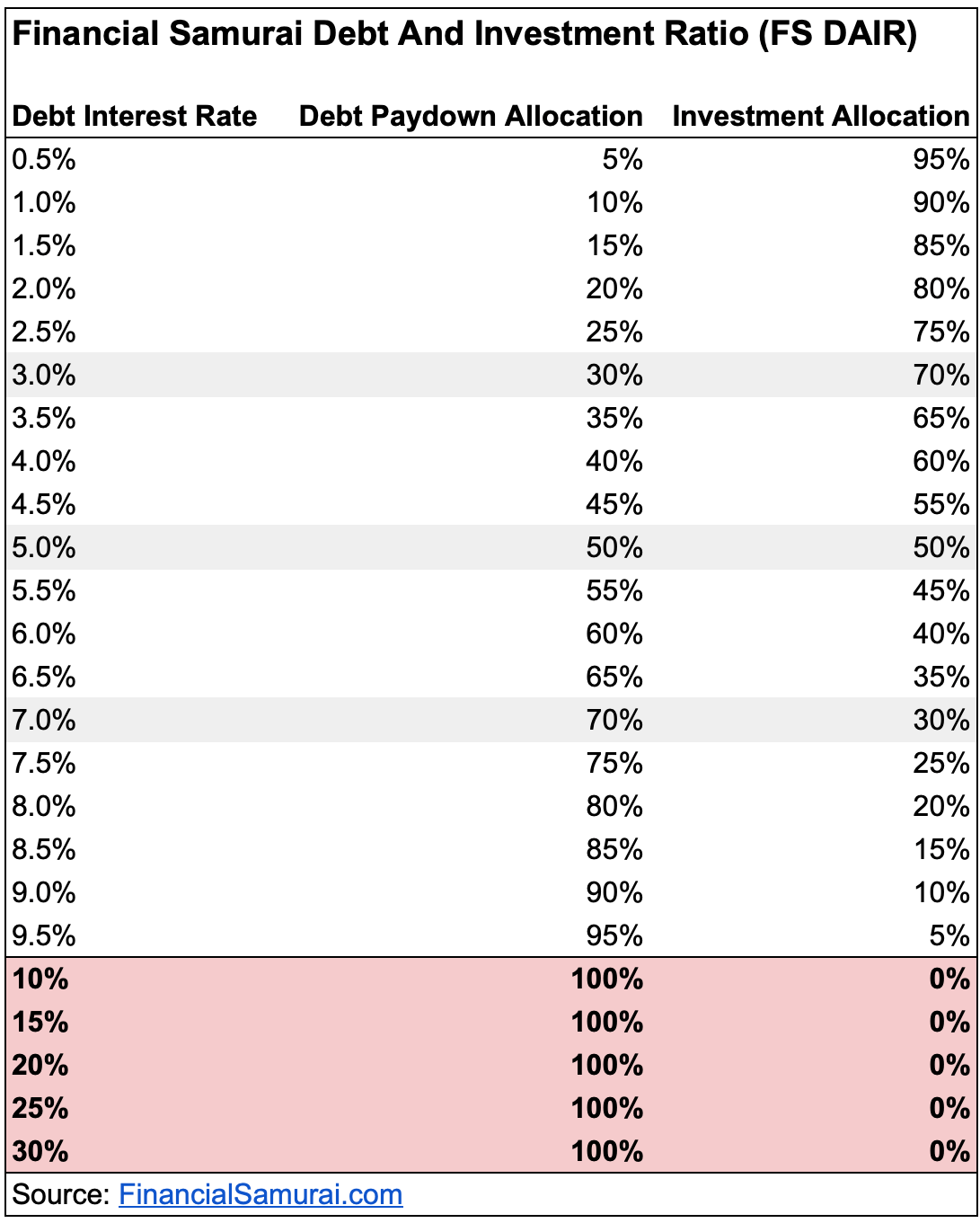

All the money you spent paying down debt instead of investing is a huge win during a stock market correction. If y'all take any type of debt and follow my FS-DAIR framework, then you're always using a percentage of your cash period to pay down debt. The debt interest rate might have but been two.v%, but that'south even so amend than losing x% in the stock market.

Further, any coin y'all spent on great experiences, tuition, nutrient, shelter, and other expenses should likewise make y'all feel amend. This is why it's important to endeavour and live the life that you want while on your journeying to financial freedom. If you can concurrently spend enough money to live a comfy life while also continuously investing, yous're hedged against investment losses.

At the end of the day, the reason why you invest is to live a better life and take intendance of time to come generations. Don't forget to enjoy your stock marketplace gains on occasion. Otherwise, all your difficult work and take a chance-taking will be for nothing.

6) Know that things could always be worse.

When someone is making more than coin than you in a balderdash market, you may experience bad if you're non a cocky-confident individual. Nonetheless, during stock market corrections, that person is also likely losing a lot more money than you.

Heck, during the global financial crunch, we were all tens of billions of dollars closer to Warren Buffett's net worth, non because nosotros were outperforming, just considering he was losing so much money! Only fifty-fifty if Warren lost 99% of his net worth, he would still exist 99% richer than all of us. So he's not a dandy example.

You might lose 35% of your stock portfolio's value in i year. Simply it could have been worse if you went on fifty% margin before the crash. Your largest single-stock position might lose 25% of its value in one day after missing earnings exceptions. Simply it could have been worse if yous decided to bring together the company right before the disappointing results.

By knowing that things could e'er exist worse, you better capeesh what you have right now. In the grand scheme of things, losing money in the stock market isn't that big of a deal. Life usually goes on if yous didn't over-leverage.

7) Stay off social media.

Social media mostly tries to curate the best versions of ourselves. You lot will seldom discover people who volition admit losing $50,000 in one day on a stock position.

During a stock market downturn, there will inevitably be people who brag nigh how they sold or shorted before the correction. Such information will piss you off. A guy who has been negative on stocks for 10 years in a balderdash market will shout how he was right all along.

Given investing can exist emotional, the almost emotionally unstable people will go on Twitter and Facebook to release their emotions. Therefore, you should avoid social media or rigorously scrub your feed.

8)Do some physical exercise.

If you lot're feeling stressed out, shut your computer, shut off your phone, and go for a nice long walk. If you want to exercise something more fun, go play a sport with some friends.

Exercising with friends e'er puts me in a good mood. Farther, exercise helps me sleep much better as well. A positive cycle!

9) Write out your thoughts.

Writing forces you to recollect more deliberately near issues. Equally a event, you volition experience more at-home during a hard fourth dimension. I highly suggest giving journaling a go if you lot don't want to start a blog like this one. At that place may be no better free therapy than writing.

Writing this mail makes me experience ameliorate about my stock marketplace losses. It is also satisfying to know this article might help a worried investor out there. Without losing so much money in Netflix, I probably wouldn't have written this post. Always recollect about the positives!

Brand Sure You Enjoy Your Gains Along The Mode

Losing coin in the stock market stinks. I get information technology. I lose money in the stock market place all the fourth dimension! Nevertheless, over the long run, stock investors tend to win far more than than we lose.

If we can continuously use some of our stock market gains to pay for a improve life, it's difficult to experience too bad. Since 2003, my strategy has been to take some gains and convert them into existent estate. This way, I get to actually enjoy some of my stock market gains while potentially making money off my master residence as well.

Over time, I've continued to catechumen some funny coin into rental properties. This increases the chances my gains volition continue given I've round-tripped enough of stocks earlier. Farther, the conversion also helps boost passive income given existent estate tends to generate much higher income than dividend stocks.

Investing in the stock market will always be a core part of building wealth. Just make sure you've got the proper nugget resource allotment. The money we lose is deserved because nosotros invested appropriately based on our take a chance tolerance.

Investing in stocks can feel empty after a while because it provides no utility. And ironically, it is that empty and emotionless feeling y'all demand to be able to concur on to when times are hard.

Stay On Top Of Your Finances

During volatile times, it's imperative to stay on elevation of your finances. To do and so, I utilise Personal Upper-case letter, the best costless wealth management tool today. Before Personal Capital, I had to log into eight dissimilar systems to rail 35 different accounts. Now I can simply log into Personal Capital to see how my stock accounts are doing. I can easily track my net worth and spending likewise.

Personal Capital's 401(k) Fee Analyzer tool is saving me over $i,700 a yr in fees. It'south important to clarify your internet worth resource allotment to run across if it's advisable. Finally, in that location is a fantastic Retirement Planning Calculator to help you manage your fiscal future.

Related posts:

What If You Buy A Abode At The Summit Of The Market?

The Proper Nugget Allocation During Your Commencement Years Of Retirement

Preparing For A 50-Twelvemonth Retirement Due To Lower Return Assumptions

Readers, how else practise yous feel amend when y'all're losing money in the stock market? Anybody buying stocks here? Articulation with 50,000+ other readers and sign up for my free weekly newsletter.

Source: https://www.financialsamurai.com/how-to-feel-better-about-losing-money-in-the-stock-market/

0 Response to "When Did the Stock Market Succeed Again"

Post a Comment